As we begin a new year and look ahead to what it holds for the paint industry, it’s important to take a moment to reflect upon where we are, where we’re going, and what challenges and opportunities await us in 2024.

When COVID-19 emerged in the U.S. in early 2020, industries across the country were deeply affected by abrupt shutdowns followed by a wavering economy (Coatings Tech Magazine). While great strides have been made on the road to a full economic recovery, we’re still feeling its effects. That’s not to say the paint industry has been spared! Rather, it continues to grapple with pandemic by-products such as supply-chain issues, heading back to the office (or not), high raw material pricing, and a slew of rate hikes in 2023.

Despite these challenges, the U.S. paint and coatings industry continues to persevere, with 2024 production expected to total 798 million gallons, a 2.9% increase from 2023 (ACA Industry Pulse | Architectural Coatings). As we begin 2024, the industry is expected to forge ahead, overcoming challenges and adapting to the evolving landscape, offering the opportunity for expansion and innovation within the sector.

Source: ACA Industry Pulse | Architectural Coatings

Logistical Challenges

Like many global manufacturers, the paint market depends on its partners to deliver the materials and products they need to serve customer demands. While the COVID-19 effect dwindles year after year, the following issues remain:

- Price of Crude Oil — Many raw materials used in both oil and acrylic paints are petroleum-derived, for which crude oil is a key source; rising prices pose a significant problem. For perspective: a $10 increase in crude oil equals a 3% rise in paint manufacturing cost (Coatings Tech Magazine). In addition, fluctuating oil prices disrupt supply-chain consistency, forcing paint manufacturers to shoulder the burden of higher transportation, production, and inventory costs.

- Raw Materials — As of mid-2023, most raw material providers were, once again, meeting demand, though typically with longer lead times than before the pandemic. Some suppliers are already out of stock through the end of 2024; therefore, paint manufacturers should have a strategy for maintaining supply. Both suppliers and paint manufacturers should be working with their Research & Development staff to prepare for any future shortages (Coatings Tech Magazine).

- Supply Chain — During COVID-19, supply-chain disruptions prompted delayed imports, capacity shortages, and elevated shipping costs. In response, paint manufacturers began to raise prices. Despite efforts to streamline processes, global uncertainty and political priorities contribute to a fragile system. Recovery is expected but challenges will persist as long as the global landscape remains in flux.

Housing Market

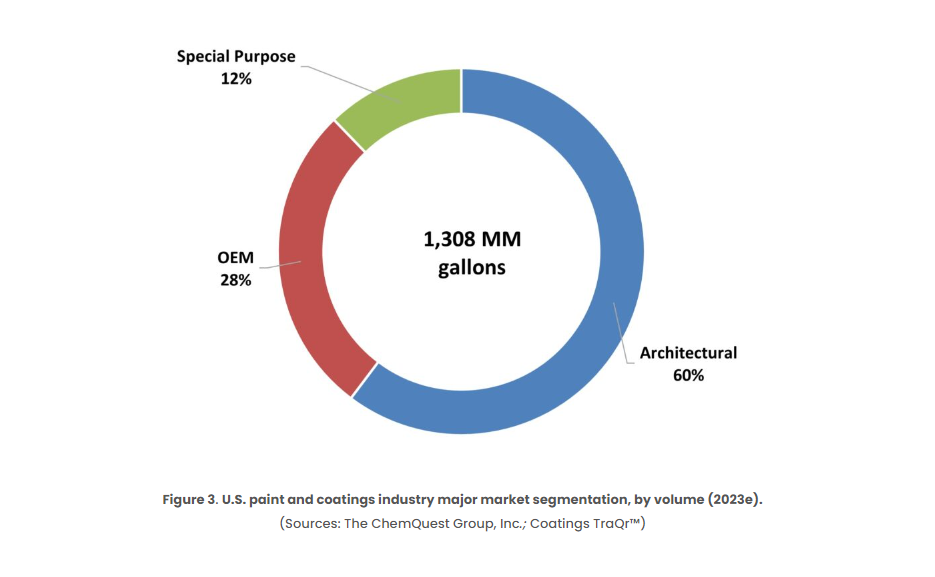

The sure sign of a solid coatings industry lies in the strength of the housing/construction market. The architectural paints sector accounts for 60% of the volume within the U.S. coatings industry and is expected to finish 2023 with a slight 1% increase. Looking forward to 2024, growth is anticipated to be 3% (ChemQuest).

Sources: The ChemQuest Group, Inc.; Coatings TraQr™

Higher mortgage rates and inflation have been pushing some potential home buyers out of the market, but that may change soon. According to CNN, the 30-year fixed-rate mortgage rate fell to an average of 6.67% in the week ending December 21, down from 6.95% the previous week.

Lower rates are bringing potential homebuyers who were previously waiting on the sidelines back into the market,” Freddie Mac’s Chief Economist Sam Khater said in a statement.

As the homebuying market begins to start moving again, it’s expected that the demand for painting services — whether from owners looking to sell or buyers wanting to repaint — will start to recover.

Rental/Multifamily

The rental/multifamily sector is headed for some challenges. For years, declining interest rates and low inventory made rental property ownership quite lucrative. However, inventory escalated in 2023, leading to a surge of 405,000 units built in the last four quarters — the highest in more than a decade (John Burns Research and Consulting).

Now, the landscape shifts. Owner costs have risen significantly, and construction starts are slowing. After the 2023 building surge, development will be substantially reduced in 2024, and apartment starts will be limited for the foreseeable future. Rising rates, insurance costs, and operating expenses further contribute to the sector’s difficulties (John Burns Research and Consulting).

The rental/multifamily construction boom has provided a revenue stream for the paint industry while the homebuying market has been tight. The construction slowdown doesn’t mean that work has dried up. Rather, opportunities may arise from pre-existing properties looking to repaint to remain competitive with newer communities.

Renovations/Remodeling

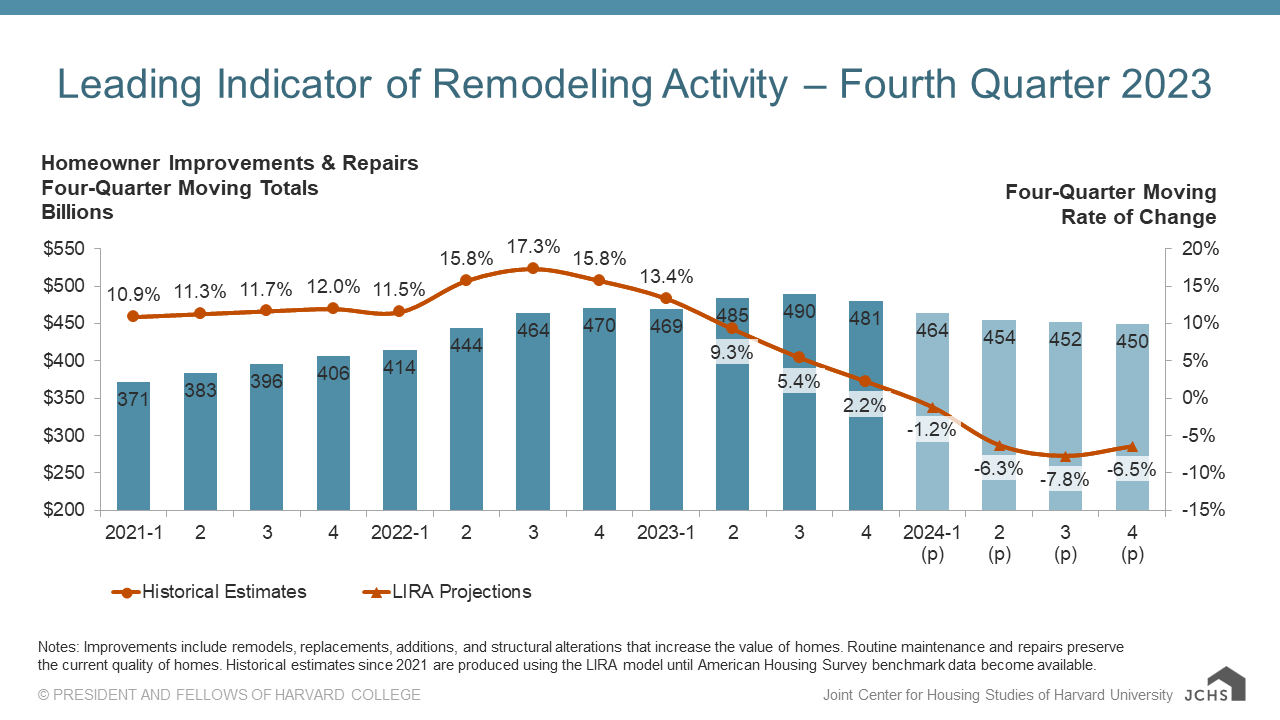

While the renovation sector has been strong for a number of years, interest rates combined with low housing inventory is expected to weigh on remodeling activity, which is estimated to decline by 6.5% (from $481 billion in 2023 to $450 billion in 2024), according to the Leading Indicator of Remodeling Activity (LIRA).

Source: Joint Center for Housing Studies of Harvard Unversity

The upside to this scenario is that, when major renovations aren’t in the budget, homeowners often look to a fresh coat of paint for an easy, budget-friendly way to update and revitalize their homes. Expect opportunities for repaints to expand this year.

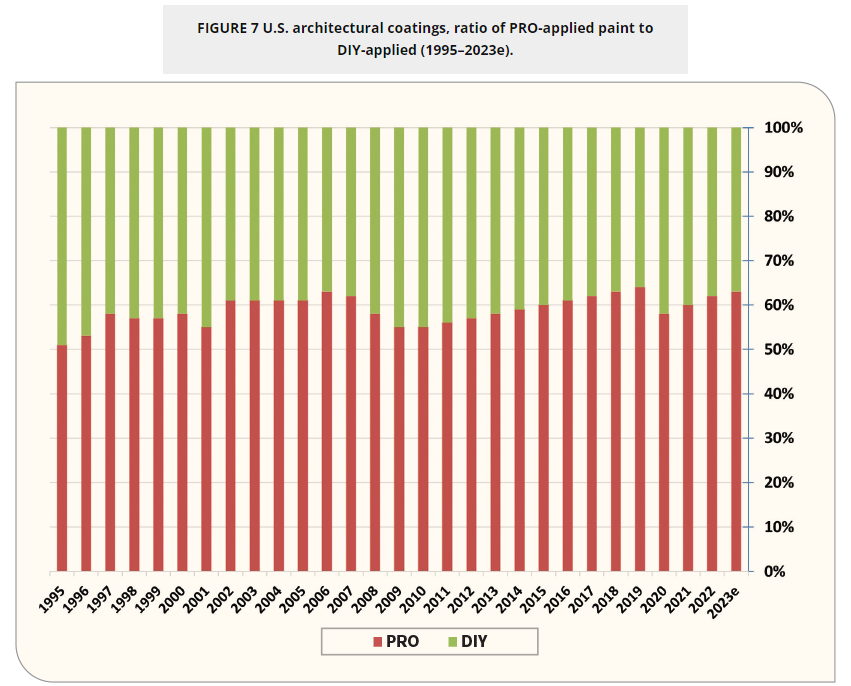

Side note: PRO vs. DIY — When it comes to home painting projects, the balance between professionals and do-it-yourselfers has tilted back and forth for years. This changed significantly, thanks to COVID-19. Case in point: From 2010 to 2019, professional work was steadily growing, yet it dropped in 2020, as homebound DIYers used this time to freshen up their spaces. From 2021 to 2023 professional work rebounded strongly, with a 2023 ratio of 63% professional to 37% do it-yourselfer, which was driven by a resurgent commercial building sector balancing out a weaker residential sector (Coatings Tech Magazine).

Source: The ChemQuest Group, Inc.

Looking Forward

So how does all of this affect the paint industry?

According to a 2023 BBB® Industry Report, here’s what we can expect over the next five years:

- Industry revenue will grow from $36.5 billion to nearly $38 billion (1.6% increase) through 2027.

- Profit margins for the industry should grow from 7.1% to over 8.4% by 2027, which translates into $3.38 million in extra profits for painters.

- Expansion is on the horizon — not only in the number of new painting companies but the number of working painting professionals. By 2027, the industry can expect another 4,600 companies and approximately 8,000 new employees to join the paint industry. Wages will comprise more than 35% of company expenses, as many painting business owners/contractors will pay higher salaries to keep key crew members such as project managers, estimators, and supervisors.

As we enter 2024, paint industry projections indicate growth, with increased revenue, profit margins, and expansion. Overall, despite ongoing challenges, the U.S. paint industry appears poised for a robust future and Behr Paint Company is here to help give you the support and guidance you need for any project, big or small. As the #1 Most Trusted Paint Brand in America*, BEHR® Paint has a complete portfolio of high-performing interior and exterior products coupled with experienced BEHR® Pro Reps to enhance your productivity and help you succeed on the job. Contact a BEHR Pro Rep today for your next project.

All of us at Behr wish you a happy and prosperous 2024!

Thanks for putting all of this information in one easy-to-read post. I stopped going to big box stores years ago for paint due to the cost. I also have found that service is tremendously preferable at smaller, local businesses.

Thanks for sharing such information. https://ruzpainting.com.au/services/commercial-industrial-painting-Brisbane/

Great read! The 2024 paint industry outlook is insightful and well-researched. Thanks for providing such valuable industry trends and forecasts.

Hello,

We’re glad you found the article insightful! If you ever have any questions, please do not hesitate to reach out to your local BEHR Pro Rep.

Kindly,

The BEHR PRO Team